Highlights

• Total advertised vacancies reach a post-crisis high in September, with 906,191 available advertised vacancies, up 27.5% from September 2013, but signals emerging that hiring growth is slowing

• Advertised salaries rise 2% year-on-year in September to £34,695, outpacing CPI inflation of 1.7%

• Competition for jobs falls to post-recession low, with 1.02 jobseekers for every advertised vacancy in September, compared to 1.86 in September 2013

• Thirty cities in the UK now have more vacancies than jobseekers, as recovery spreads out across the nation

• Customer Service sector surges ahead, with advertised vacancies up 6% since June 2014

Total advertised vacancies reached a post-recession high in September, buoyed by retailers with one eye on the festive period, according to the latest UK Job Market Report from Adzuna.co.uk.

The number of advertised vacancies in the UK rose 27.5% to 906,191 in September, up from 710,859 in September 2013. It marked the highest number of total advertised vacancies since the recession, and the fourth consecutive month of growth.

Advertised salaries also reached a post-recession high, growing 2% year-on-year in September. The UK’s average advertised salary now stands at £34,695, compared to £34,005 a year ago. Annual salary growth outpaced CPI inflation (1.7%) for the second consecutive month; in real terms advertised salaries grew by £260 over the last year.

Jobseeker competition also declined significantly in the last twelve months. The ratio of jobseekers to vacancies fell from 1.86 in September 2013 to 1.02 in September 2014.

Table 1:

August 2014 September 2014 Monthly Change Annual change from September 2013

UK Vacancies 905,297 906,191 +0.1% +27.5%

Jobseekers per Vacancy 1.06 1.02 -0.04% -45.3%

Av. Advertised UK Salary £34,463 £34,695 +0.7% +2.0%

Andrew Hunter, co-founder of Adzuna, explains: “The cautious green shoots of job market growth are now beginning to firmly take root as businesses revel in new-found economic confidence. The number of vacancies on offer is rapidly expanding, and UK vacancies crossed the one million mark in the last few days, which bodes well for vacancy levels in October. At the same time unemployment has fallen to below two million: its lowest level since 2008. That potent combination of factors is catalysing a recovery in salaries – as employers raise wages in order to attract the talent they need to respond to an uptick in business demand. Employers are also increasingly aware of the bounty of opportunities available to existing employees looking to move jobs, and are handing out pay rises to prevent talent falling through the cracks.”

Monthly slowdown

Despite annual improvements, there are some initial signs that rate of the job market recovery is starting to slow. Advertised vacancies grew 0.1% month-on-month in September, much lower than the 3.7% monthly growth witnessed in August. Advertised salary growth of 0.7% between August and September was the slowest monthly growth since May 2014.

At the same time, much of the vacancy growth is being driven by part-time workers. There are currently 6.8m British employees in part-time work, the highest figure on record.

Andrew Hunter comments on signs of a vacancy growth slowdown: “The job market recovery may be starting to plateau following a period of huge improvements. Part of this problem is a weakening global economy. The Eurozone is starting to falter, and may have a weakening effect on our own recovery. The markets are giving us clear warning signs that tougher economic times are ahead, and we many have to rein in our expectations for the coming months.

“Positive vacancy growth is also masking an underlying trend to part-time work. There are more opportunities on offer than a year ago, but more of these are part-time positions offered to satisfy the seasonal rush, with many companies taking on tens of thousands of extra staff to cater for Christmas demand. Zero hours contracts are also propping up the vacancy count.”

Customer Service surge takes off

The Customer Service sector has already begun to show signs that the Christmas period is approaching as both salaries and vacancies surge. Since the beginning of summer, Customer Service vacancies have grown 6% from 20,250 in June to 21,423 in September. At the same time, advertised salaries have also risen in the sector. The average advertised salary for Customer Service workers rose 11.7% year-on-year to £21,685 in September.

This increase in Customer Service roles has been buoyed by growing consumer confidence, as wages pick up and spending power grows. Royal Mail and Amazon have announced they will create 32,000 temporary jobs over the seasonal period to keep up with the consumer demand.

The concerns around a skill shortage were amplified in September as advertised salaries in the Trade & Construction sector increased 9.8% year-on-year. The lack of skilled personnel in the construction industry is forcing wages higher as contractors and suppliers tussle for workers. Since January 2014, Trade & Construction jobs have increased by 68% as the industries try to expand, but filling these roles has become troublesome.

Table 2: Biggest improvers – Job sector by average salary

Job Sector Average Salary Salary % change 12 months

Customer Service Jobs £21,685 +11.7%

Manufacturing Jobs £30,654 +10.0%

Trade & Construction Jobs £37,625 +9.8%

IT Jobs £45,926 +8.7%

Scientific & QA Jobs £37,948 +7.8%

Commenting on the performance of these sectors, Andrew Hunter explains: “Low inflation, wages picking up and growing economic confidence has become a winning combination for the Customer Service sector. Most importantly, consumers with more money to spend are creating a need for a variety of jobs, stretching from retail to product manufacturing. The sluggish salary growth many have endured since the financial crisis is beginning to wear off, giving us more money to spend in the shops during seasonal months.

“But we must not take our eye off the ball when it comes to the skills shortage. The UK is already beginning to feel the pinch from a lack of highly trained workers in sectors such as construction. If we are to see future economic expansion then we much put all our energies in creating the skilled workers of tomorrow, who are desperately needed today.”

UK cities prosper

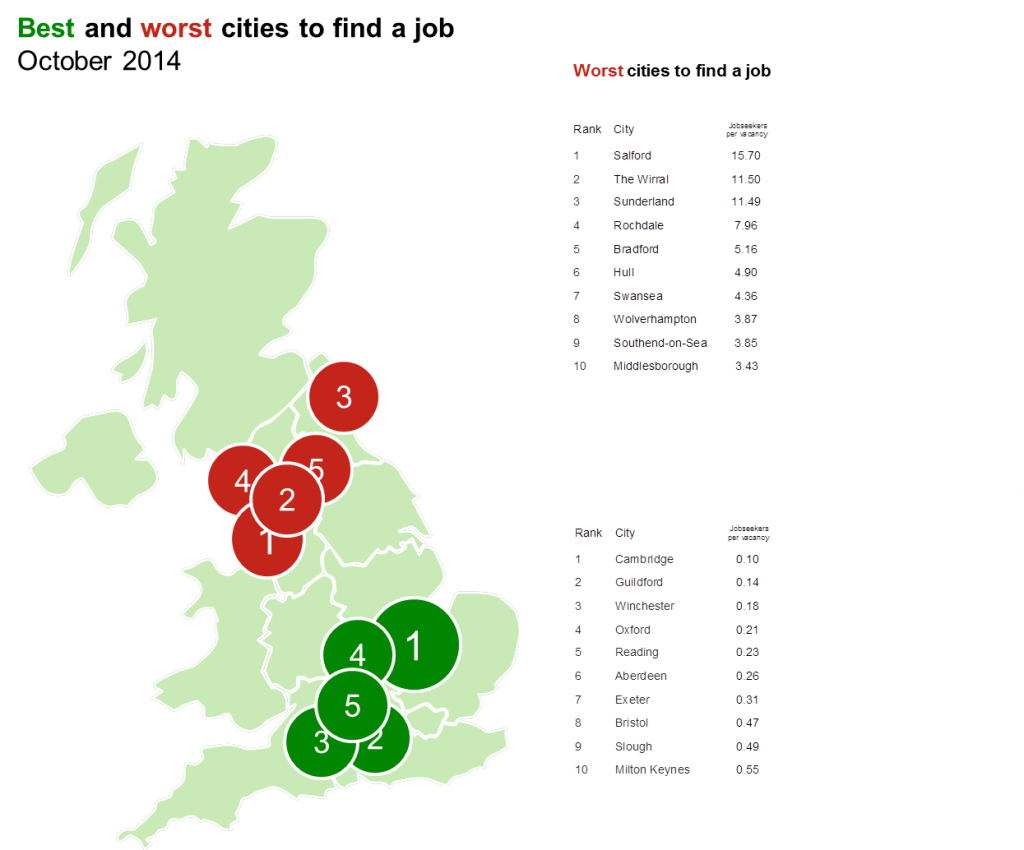

Thirty UK cities now boast more vacancies than jobseekers as the economic recovery surges in many major conurbations. The cities experiencing this growth surge are geographically diverse. Cities in the North such as Warrington and Manchester are performing as well as London and the South East, showing the recovery is being felt up and down the country. Aberdeen continued its strong economic performance by leading Scotland’s vacancies to job seekers ratio and coming sixth nationally.

More positive news for the North continued as both the North East and Yorkshire and The Humber experienced far higher year-on-year average salary growth than London and the South East.

Andrew Hunter, co-founder of Adzuna, comments: “The northern powerhouses our politicians seem so desperate to see are beginning to pick up pace in economic growth. Although starting from a low base due to particular hardship after the recession, it is encouraging to see more good news for the North.

“We still have a long way to go until we see a truly geographically balanced economy, but renewed infrastructure efforts in the North will help. In the meantime, expect the gap continuing to close at a steady rate as London’s salary growth remains sluggish.”

Table 3:

Region Average salary Annual change

Wales £30,351 +15.8%

North East England £30,316 +8.0%

Northern Ireland £29,682 +8.0%

South West England £31,691 +7.5%

Yorkshire and The Humber £30,558 +7.2%

North West England £30,818 +5.9%

West Midlands £31,667 +5.4%

East Midlands £30,470 +3.9%

Eastern England £32,406 +2.9%

UK £34,463 +2.0%

South East England £32,798 +1.9%

London £42,747 +1.6%

Scotland £33,067 -0.7%